Year-end closing like a pro in Dynamics Business Central (or NAV)

31 December is just around the corner, and like every year-end, the dreaded period that every accountant and administrator dreads is just around the corner: the accounting and fiscal closing. This process may seem like a mere administrative formality, but we can safely say that it is also an opportunity to analyse growth for clients, establish forecasts and set both short and long term objectives so that the business can grow year by year.

At Dynasoft we propose four steps to make the accounting process as easy and profitable as possible:

YEAR-END CLOSING:

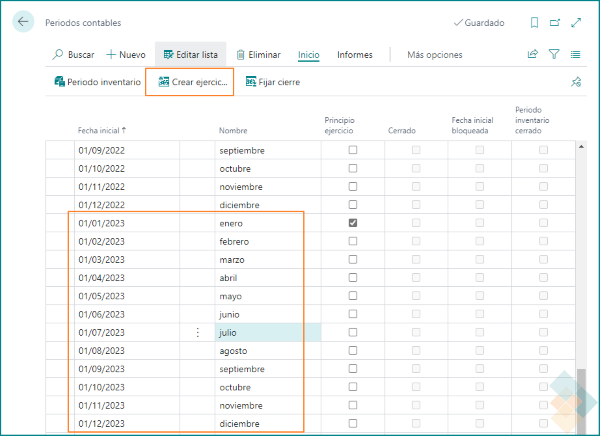

1. Close accounting periods:

This process can be done at any time and is an essential requirement to be able to make the regularisation entry.

REMEMBER !!!! This process is irreversible, you can continue to register movements in the period that will be marked as "post closing entry" in accounting movements, this way you will be able to identify those adjustment movements made by request of audits.

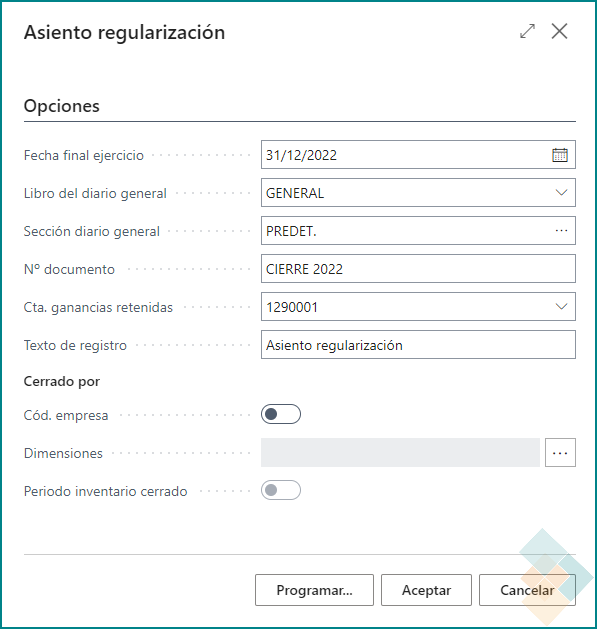

2. Generate the adjustment entry:

Once the year is fully adjusted and closed, the process of creating the regularisation entry must be launched. You can locate the process to generate the journal entry by using the search engine on the top left of the screen.

This entry has to be made once the period is closed.

OPENING YEAR 2023

Tanta importancia tiene el cierre, como la apertura del año siguiente. El 2023 deberá empezar siguiendo estos pasos:

3. Review and update the serial numbers:

We recommend checking that the numbering for the next year is correct. In case you want to use a new numbering, this is a good time to change it.

.png)

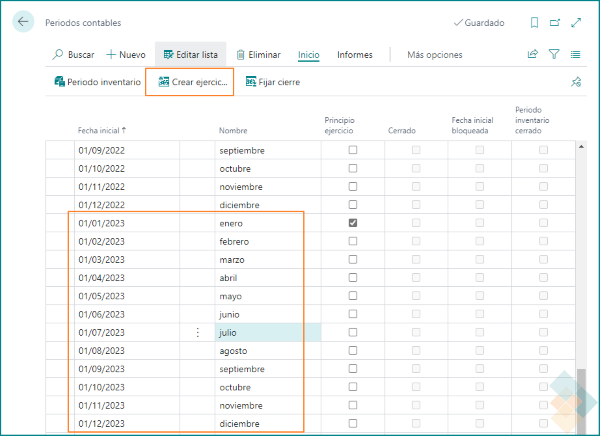

4. Create the new accounting period:

Another mandatory task on these dates is the creation of the accounting period (as long as the accounting period coincides with the calendar year). Access "Accounting periods" from the search engine and check that the new accounting period for the year 2023 has been created.

As always, our team of Business Central consultants is at your disposal to clarify any issues that may arise. If you have any further questions, please contact us and we will be happy to assist you in this process. You can contact us via the dynasoft ticket portal, by telephone on 971 35 99 57 or by email.

Share